Announcements

News & Events

Articles

|

|

|

|

NRBSL takes pride in the election of its very own Senior Vice President and Chief of Staff Marcelo N. Jampil as Director of RBAP for FY2021-2022 during the association’s General Membership Meeting held last May 25, 2021 via teleconference. SVP Jampil representing Region III-A is joined by 14 other esteemed representatives from across the country to take on the leadership role on behalf of 413 member-banks. The Directors of RBAP are screened according to qualification standards set under its By-laws and are endorsed by their respective regional and provincial federations which MNJ adequately possesses. SVP Jampil’s representation in the national front is expected to bring to the next level the advocacies of NRBSL towards local economy development and advancement of supply chain eco-system. His election banners NRBSL anew in the industry of rural banking and its brand of professionalism and proficiency. |

Building Local Economies Through Lasting Partnerships

Collaboration work, forging alliances and partnership-building have always been the strategy of the New Rural Bank of San Leonardo in pursuing its mandate as a development finance institution and in meeting its business objectives. Starting in 1994 with a co-financing agreement with a foreign partner, the next 27 years of steady growth was nurtured by the Bank’s cooperation with various funding and guaranteeing institutions, development organizations, government agencies including systems and technology solutions providers among others. Most of these institutional relationships are long-standing reckoned from initial deals that progressed overtime to multiple transactions and new opportunities. These ties have been sustained and strengthened by mutual trust and reciprocal benefits the parties derived from the engagement towards the fulfillment of shared advocacies. The recent and current involvements of NRBSL are marked by the same synergy to work with partners and to support peers in the industry. To date, NRBSL has helped the Agricultural Credit and Policy Council (ACPC) disbursed P315 million loans at the height of the pandemic in favor of small farmer and agri-preneurs not fewer than 5,475 of them and counting. In the second half of 2020, NRBSL served over 170,000 beneficiaries of government’s social amelioration program through on-boarding with co-branding digital payment platforms of partner universal banks. Hundreds of MSME’s benefited from NRBSL’s financing program in partnership with a number of LGUs in Nueva Ecija and some parts of Tarlac and Aurora. By way of its accreditation as a Rural Financial Institution under Republic Act 10000, NRBSL assists non-agriculture oriented banks in their alternative compliance with the Agri-Agra Law. In line with its evolving business model, NRBSL is dedicated in building a supply chain eco-system to help facilitate collaboration between and among the various actors in agriculture production and enterprise development.

Guidance on De-Listing and Unfreezing of Funds and Other Others related to Targeted Financial Sanctions (TFS)

REGULATORY ISSUANCE NO. 5 |

|

Guidance on De-Listing and Unfreezing of Funds and Other Others related to Targeted Financial Sanctions (TFS)(Click the image to view) |

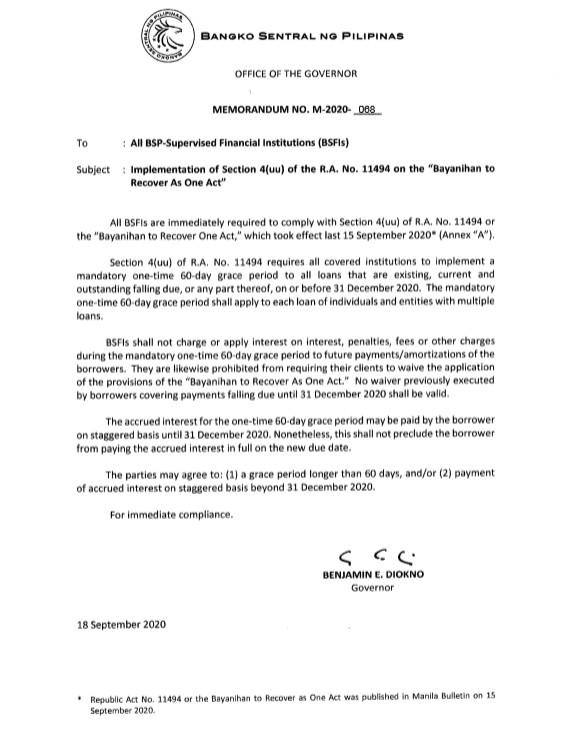

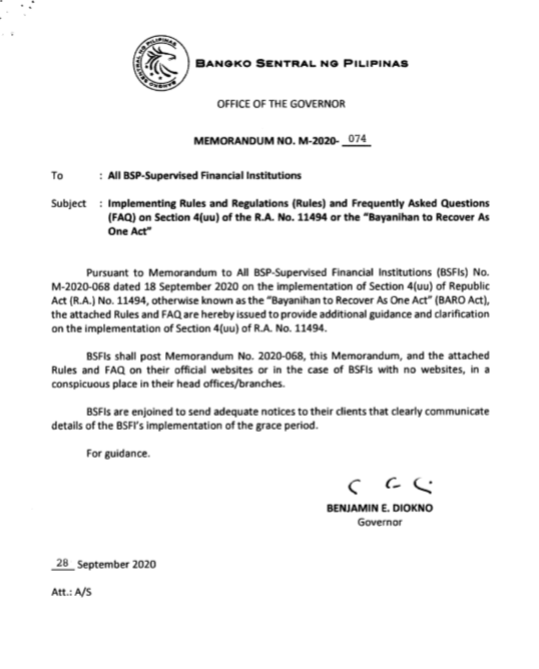

BSP Issues Memorandum No. M-2020-068 and M-2020-074 to All BSP-Supervised Financial Institutions (BSFIs)

CCLRB Elects NRBSL VP - Chief of Staff Marcelo N. Jampil as President (2019 - 2020)

NRBSL's Marcelo N. Jampil was elected as CCLRB President (2019 - 2020). He and the rest of the officers took their oath of office at Widus Hotel and Casino at Clark Freeport Zone last August 16, 2019.

NRBSL Leads CCLRBs Annual Management Conference and Asian Study Tour

New Rural Bank of San Leonardo (N.E), Inc.(NRBSL) Senior Vice President Marcelo N. Jampil assumed the presidency of the Confederation of Central Luzon Rural Banks (CCLRB) for FY2019-2020 [more...]

BSP Issues a Renewal of NRBSL Certificate of Agri-Agra Accreditation

The BSP recently issued their official letter of approval for the renewal of the Certificate of Accreditation in favor of NRBSL as a Rural Financial Institution (RFI) under RA 10000 or Agri-Agra Law. The grant of renewal is an indication that NRBSL’s service to the agriculture industry is not fleeting. The Bank’s preference in favor of farmers is historically proven. More so, the focus of NRBSL’s[more...]

PCHC Approves NRBSL as Clearing Subscriber in the Check Image Clearing System (CICS)

The PCHC Board in its meeting of April 4, 2019 approved the intent of NRBSL to participate as a Clearing Subscriber in the Check Image Clearing System (CICS) of the Philippine Clearing House Corporation.

NRBSL Offers Preferred Shares

NRBSL is now ready to issue preferred shares to both private individuals or organizations local and overseas and government agencies. Last January 18, 2018 the Securities and Exchange Commission (SEC) has issued the Certificate of Registration [more...]

“Asian Development Bank ADB) and Bangko Sentral ng Pilipinas (BSP) select NRBSL as among six (6) pilot banks to undertake Agriculture Supply Chain Financing (AVCF) Framework”

From a nationwide selection, NRBSL emerged as among the six (6) pilot banks to undertake AVCF under the joint project of Asian Development Bank ADB) and the Bangko Sentral ng Pilipinas (BSP). As early as 2016, the BSP had issued Circular No. 908 on agricultural value-chain financing framework. Through this regulatory issuance, BSP aims “to provide better access to credit for the agriculture and fisheries sectors” and to encourage banks to lend more to them using incentives and allowing innovative ways to mitigate credit risks. Interestingly, the flow of funds including some of the risks in the exposure is transferred from a single farmer-borrower to other actors in an agricultural value chain. The New Rural Bank of San Leonardo took cognizance of this lending scheme as a sound alternative to traditional approaches and wasted no time to forge partnership Safe and Sound Agriculture Cooperative as its Related Party Aggregator to help initiate the formalization and/or organization of a value chain and/or which offers services that aim to strengthen existing value chains”. Indeed, the need for new ways to pursue loan development is pressing in the light of the economic downturn caused by this public health crisis and the age-old vulnerabilities of small farmers from natural and human-induced calamities.

NRBSL Leads CCLRBs Annual Management Conference and Asian Study Tour

NRBSL Leads CCLRBs Annual Management Conference and Asian Study Tour

New Rural Bank of San Leonardo (N.E), Inc.(NRBSL) Senior Vice President Marcelo N. Jampil assumed the presidency of the Confederation of Central Luzon Rural Banks (CCLRB) for FY2019-2020. During his term of office, SVP Jampil spearheaded the holding of CCLRB’s Annual Management Conference with the theme “Strategic Alliances towards Sustainability and Competitiveness”. The conference was held in Baguio Country Club, Baguio City from February 17 to 18, 2020 with no less than Deputy Governor Chuchi Fonacier of the Banko Sentral ng Pilipinas (BSP) as the Guest of Honor and Keynote Speaker. Representatives from various governmental agencies and private sector joined the impressive line-up of speakers and resource persons for the Confederation’s premier two-day gathering. During the event’s fellowship night, the iconic boy band of the 70’s “The Boyfriends” performed their greatest hits to the delight and entertainment of conference participants and guests.

SVP Jampil also led a CCLRB delegation on a Study Tour in Sri Lanka and India from February 25, 2020 to February 28, 2020. The Study Tour was organized in coordination with the Asia-Pacific Rural and Agricultural Credit Association Center for Training and Research in Agricultural Banking, Inc. (APRACA-CENTRAB) after CCLRB became an official member during the incumbency of Mr. Jampil as Confederation President. The Study Tour included visits to the Bank of Ceylon in Colombo, Sri Lanka and to the National Bank of Agriculture and Rural Development (NABARD) in Mumbai, India.

|

|

|||

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Branch Network Expansion

Branch Network Expansion

NRBSL is set to open at the most four (4) new branches up to the last quarter of 2018. Once completed, this will bring to twenty (20) the Bank’s system of branches, just four (4) units short of the targeted 24-branch network under the five year (5) expansion thrust set forth in 2015. With two and half years remaining, NRBSL is well within its projected timeline for expansion.

|

NRBSL Bags Gawad CFI Awards for 2 Years in a Row

NRBSL Bags Gawad CFI Awards for 2 Years in a Row

For 2 consecutive years 2016-2017, NRBSL became the recipient of the coveted 1st prize award of the Gawad CFI by the Land Bank of the Philippines.

|

|

|

President Abundio D. Quililan, Jr. during an interview with ABS-CBN Program Swak na Swak |

NRBSL Partners with LBP and DBP in the Deployment of Automated Teller Machines (ATM)

NRBSL Partners with LBP and DBP in the Deployment of Automated Teller Machines (ATM)

In partnership with the 2 leading government financial institutions, Development Bank of the Philippines (DBP) and Land Bank of the Philippines (LBP), NRBSL branches will have ATM station to service with its clientele.

|

|

Local Economy Development Framework Focused on Dingalan

Local Economy Development Framework Focused on Dingalan

The pervasiveness of poverty is caused by a variety of factors hence it necessitates multi-faceted interventions if one were to transform the poor from subsistence living to one of sustainable income generation. Standing alone, NRBSL knew that its role is limited to financial service delivery. However, development initiative requires various interventions starting from welfare provision and social preparations to higher level and sustainable development initiatives that include capability building and other support services towards increasing productivity and diversified value-adding economic activities.

NRBSL is a proponent of this local economy development framework and it has chosen Dingalan, Aurora where the town’s leadership provides a sympathetic local government. The Bank joins a consortium of like-minded agencies united in understanding of the development objectives for the area. The consortium members have agreed on the local economy development framework of Dingalan around its marine resources both for livelihood and tourism purposes. The role of the consortium with its members' respective fields of expertise is to help build the local economy by bringing services to these sectors to enhance productivity and growth.

Digital Transformation and Data Security Infrastructure

Digital Transformation and Data Security Infrastructure

NRBSL has migrated to an enhanced Integrated Core Banking System Express-O. The migration to this new core banking software developed by MB Philippines in partnership with the University of the Philippines System Information Technology Foundation (UPSITF), has started to revolutionize NRBSL’s overall banking operations. While working on the software’s full functionality, the Bank begins to experience the enhanced features of the Express-O with the advantages of an on-line, centralized and fully integrated core banking system. This new CBS will facilitate monitoring of a wider branch network, easier report generation and other conveniences of automated technology.

The issue on data security is being taken seriously by NRBSL in the light of cyber attack incidences in the banking industry. The transfer of the Bank’s data and system servers in a more secured, off-site location under PLDT’s Vitro Co-location facility has been undertaken as part of the enhancements in IT risk management.

Given the continuing system development activities on Express-O, strict monitoring of day-to-day system usage, end-of-day closing of transactions and month-end data processing is being observed to minimize if not avoid system downtime situations. A composite team from IT/MIS, Accounting and Internal Audit Units including representatives from the service provider has been organized as part of contingency measures particularly during critical points in the use of the ICBS.

|

Organizational Development

Organizational Development

In preparation for its growth perspective, the Bank has beefed up its management pool and re-organized its ranks to prepare the organization in meeting the required quality standards of personnel for expanded banking operations and to help ensure management succession.

In July 2017, NRBSL launched a Management Training Program, the first ever in the 23-year history of our Bank. Not more than 18 individuals out of 30 or so original enrollees survived the rigors of schooling with a total of 552 training hours. NRBSL’s MTP course syllabus ranks among the bests there is as it comes with a comprehensive scope of the entire banking operations and arranged in a schedule according to a logical sequence. This approach was adopted so that trainees shall experience a simulated walk-through of branch operations from the setting-up of a branch office, processing of loans and servicing of deposits; use of core-banking system, legal and asset management; internal controls and compliance functions.

With our MTP graduates, NRBSL has a pool of personnel with deeper and broader understanding of banking and business operations necessary to sustain the Bank’s growth perspective.

|

| NRBSL MTP Participants w/ Chairperson Andres G. Panganiban & Members of Management Team in a photo opportunity during an audience w/ BSP Dep. Gov. Chuchi Fonacier. |

Pursuit of Pro-Mission Mission

Pursuit of Pro-Mission Mission

Out of the total P168M net increase in loans in 2017, about P125M are lent to small farmers and graduating MF clients. This level of performance proves that the Bank is committed in servicing these sectors in line with its advocacy as a development finance institution.

NRBSL has always been true to its mission as a financial institution that sees agricultural sector as its long-standing market niche in the accomplishment of its social objectives. In 2017, the Bank’s intention to grow and excel at a higher level of rural banking is highlighted by its service to an even larger number of small farmers and small entrepreneurs thus positively assisting local and marginalized rural communities. The financial services of the Bank have remained accessible, affordable and reliable to these sectors despite the inherent risks in unsecured agricultural portfolio. Out of 7,809 active loan accounts, 7,055 are uncollateralized loans lent to landless farmers, entrepreneurs or fixed-income earners.

Unsecured Loan Portfolio

| 2017 | 1,102 | 25,342,392.39 | 4,443 | 271,976,069.61 |

| 2016 | 954 | 18,175,519.95 | 1,712 | 94,995,085.17 |

| Increase (Decrease) | 148 | 7,166,872.44 | 2,731 | 176,980,984.44 |

| Percentage Inc (Dec) | 16% | 39% | 160% | 186% |

| Agrarian | 4,830 | 284,048,327.12 | 68.46% | 81.37% |

| Agricultural | 49 | 2,656,231.45 | 0.69% | 0.76% |

| Housing Purposes | 10 | 1,266,721.33 | 0.14% | 0.36% |

| Other Purposes | 688 | 11,815,597.63 | 9.75% | 3.38% |

| Personal Use Purposes | 291 | 15,567,782.18 | 4.12% | 4.46% |

| Microfinance | 1,102 | 25,342,392.39 | 15.62% | 7.26% |

| SME | 85 | 8,369,206.34 | 1.20% | 2.40% |

| Total | 7,055 | 349,066,258.44 | 100.00% | 100.00% |

| Total Loan Portfolio | 7,809 | 821,891,458.87 | ||

| Percentage of Unsecured Loans to Total Loan Portfolio |

90.34% | 42.47% | ||

NRBSL improves its industry standing

NRBSL improves its industry standing

NRBSL's ranking has improved in all aspect of financial performance from the previous quarter-end report and now officially among the country's top 25 RBs in terms of total resources. In the course of just five quarters, NRBSL has moved-up from 36th to 24th place in the competitive field.

| As to Total Assets | 24 | 1,352,643,678.59 | 26 | 1,314,639,203.99 | 36 | 1,037,142,336.04 |

| As to Total Loans & Receivables, net | 25 | 769,448,958.79 | 28 | 771,335,740.08 | 32 | 621,561,039.90 |

| As to Total Deposit Liabilities | 38 | 611,756,429.65 | 43 | 575,682,057.21 | 53 | 508,033,460.52 |

| As to Total Stockholder's Equity | 40 | 197,445,406.02 | 43 | 190,110,684.57 | 45 | 174,896,108.52 |

NRBSL Renews Certificate of Accreditation

NRBSL Renews Certificate of Accreditation

The BSP recently issued their official letter of approval for the renewal of the Certificate of Accreditation in favor of NRBSL as a Rural Financial Institution (RFI) under RA 10000 or Agri-Agra Law. The grant of renewal is an indication that NRBSL’s service to the agriculture industry is not fleeting. The Bank’s preference in favor of farmers is historically proven. More so, the focus of NRBSL’s lending program are not the large scale agricultural producers but the small and often assetless farmers who do not have access to affordable credit.

With this renewal, NRBSL is authorized to retain and accept more deposits from other banks as alternative compliance to said regulation. This certification has become special as there are only eight remaining financial institutions the BSP granted accreditation in its latest announcement. NRBSL takes pride in being one of the few. It only shows that NRBSL fulfills its mandate in strictest sense as defined under Republic Act 7353.

Unwrapping joy and spreading holiday cheer at the Nueva Ecija Federation of Rural Banks Christmas Party! 🎄🌟

New Rural Bank of San Leonardo was thrilled to be part of the festive celebration at Plaza Leticia, Cabanatuan City on December 7, 2023. Here's to a season filled with laughter, good company, and the spirit of community. 🎉

Unwrapping joy and spreading holiday cheer at the Nueva Ecija Federation of Rural Banks Christmas Party! 🎄🌟

New Rural Bank of San Leonardo was thrilled to be part of the festive celebration at Plaza Leticia, Cabanatuan City on December 7, 2023. Here's to a season filled with laughter, good company, and the spirit of community. 🎉

Our Dear President Abundio D. Quililan Jr. delivers our Agricultural Value Chain Financing (AVCF) Program to the high-level delegation from nine (9) Agricultural and Cooperative banks of India (National Bank for Agriculture and Rural Development [NABARD], Bankers Institute of Rural Development [BIRD], Indian Government - Agriculture Assistant Secretary et al.): Asia-Pacific Rural and Agricultural Credit Association - Centre for Research and Training in Agricultural Banking (APRACA-CENTRAB) International study tour on AVCF last 24 November 2023 at NRBSL Corporate Training room, San Leonardo, Nueva Ecija.

Our Dear President Abundio D. Quililan Jr. delivers our Agricultural Value Chain Financing (AVCF) Program to the high-level delegation from nine (9) Agricultural and Cooperative banks of India (National Bank for Agriculture and Rural Development [NABARD], Bankers Institute of Rural Development [BIRD], Indian Government - Agriculture Assistant Secretary et al.): Asia-Pacific Rural and Agricultural Credit Association - Centre for Research and Training in Agricultural Banking (APRACA-CENTRAB) International study tour on AVCF last 24 November 2023 at NRBSL Corporate Training room, San Leonardo, Nueva Ecija.

In almost four years as program partner, NRBSL has sustained its role as among the premiere lending conduits of the Agricultural Credit and Policy Council (ACPC) in the service of its targeted sectors of small farmers and agri-business enterprises in the countryside. NRBSL is on-boarded in practically all credit program offerings of ACPC and a regular participant in its various campaigns and activities. Back in November 2020, NRBSL received anew from ACPC another approval that brings to P120M the fund allocation for the implementation of Micro and Small Agribusiness Loan Program (Agri-Negosyo or ANYO) alone excluding other programs funds the Bank received in the course of the partnership. Included in this funding is the servicing of vendors' associations and agri-based entrepreneurs in high-demand markets in Metro Manila.

Last April 20, 2021 NRBSL participated in ACPC-sponsored Policy Forum on the State of Agricultural Financing in the Philippines. NRBSL joined other stakeholders from the private and government financing sectors, government agencies, farmers/fisherfolk organizations and the academe in a fruitful discussion on various issues in agricultural finance in the Philippines and on-going initiatives towards better credit access among small farmers. During the forum, NRBSL President and CEO Abundio D. Quililan, Jr. delivered a reaction paper on the presentation of experts on agricultural lending using NRBSL’s perspective and experience as a long-standing practitioner.

In almost four years as program partner, NRBSL has sustained its role as among the premiere lending conduits of the Agricultural Credit and Policy Council (ACPC) in the service of its targeted sectors of small farmers and agri-business enterprises in the countryside. NRBSL is on-boarded in practically all credit program offerings of ACPC and a regular participant in its various campaigns and activities. Back in November 2020, NRBSL received anew from ACPC another approval that brings to P120M the fund allocation for the implementation of Micro and Small Agribusiness Loan Program (Agri-Negosyo or ANYO) alone excluding other programs funds the Bank received in the course of the partnership. Included in this funding is the servicing of vendors' associations and agri-based entrepreneurs in high-demand markets in Metro Manila.

Last April 20, 2021 NRBSL participated in ACPC-sponsored Policy Forum on the State of Agricultural Financing in the Philippines. NRBSL joined other stakeholders from the private and government financing sectors, government agencies, farmers/fisherfolk organizations and the academe in a fruitful discussion on various issues in agricultural finance in the Philippines and on-going initiatives towards better credit access among small farmers. During the forum, NRBSL President and CEO Abundio D. Quililan, Jr. delivered a reaction paper on the presentation of experts on agricultural lending using NRBSL’s perspective and experience as a long-standing practitioner.