Welcome to NRBSL's Website

Building Local Economies Through Lasting Partnerships

Collaboration work, forging alliances and partnership-building have always been the strategy of the New Rural Bank of San Leonardo in pursuing its mandate as a development finance institution and in meeting its business objectives. Starting in 1994 with a co-financing agreement with a foreign partner, the next 27 years of steady growth was nurtured by the Bank’s cooperation with various funding and guaranteeing institutions, development organizations, government agencies including systems and technology solutions providers among others. Most of these institutional relationships are long-standing reckoned from initial deals that progressed overtime to multiple transactions and new opportunities. These ties have been sustained and strengthened by mutual trust and reciprocal benefits the parties derived from the engagement towards the fulfillment of shared advocacies. The recent and current involvements of NRBSL are marked by the same synergy to work with partners and to support peers in the industry. See More.....

What's New

LOOK: New Rural Bank of San Leonardo (N.E.), Inc. Marks 31st Anniversary with a Eucharistic Celebration

June 27, 2025

In a heartfelt observance of its 31st founding anniversary, the New Rural Bank of San Leonardo (N.E.), Inc. held a Solemn Eucharistic Celebration on Friday, June 27, 2025, at corporate office.See More.....

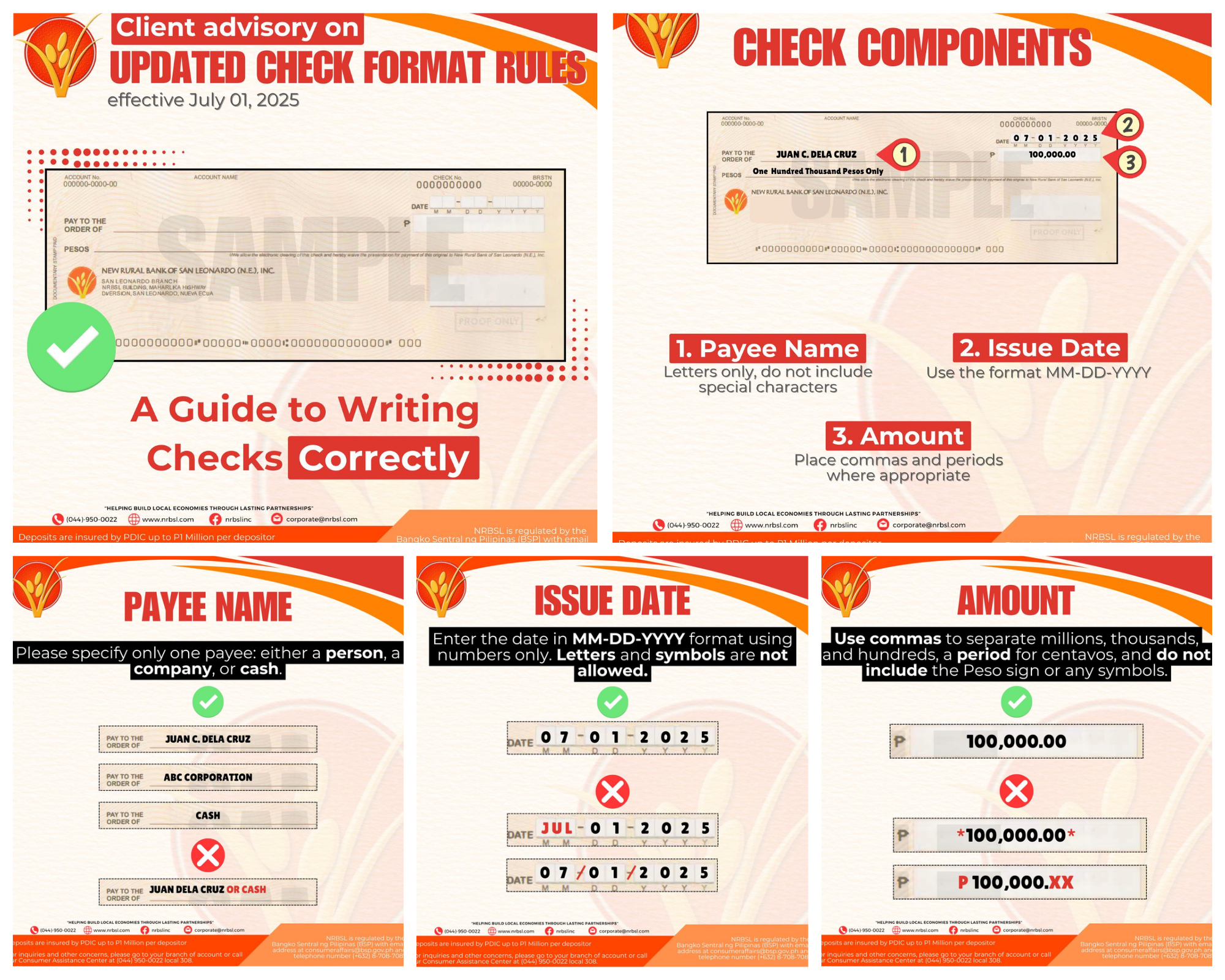

Write Checks Correctly!

July 1, 2025

New check format rules take effect starting today, July 1, 2025.

Here's your guide to ensure smooth transactions!See More.....

New Rural Bank of San Leonardo (N.E) Inc., named National Grand Winner for Outstanding Rural Financial Institution (Bank) during the 50th Gawad Saka: Parangal sa mga Natatanging Magsasaka at Mangingisda conferred on June 30,2025 at the Philippine Rice Research Institute in Science City of Munoz, Nueva Ecija.

June 30, 2025

Mr. Juvenal A. Moraleda Chairman of the Board of Directors together with Mr. Abundio D. Quililan Jr., President and CEO and Ms. Francisca C. Lopez, Vice President and Sector Head of Inclusive Finance Sector received the award of recognition by the Department of Agriculture and the President of the Republic of the Philippines, His Excellency President Ferdinand R. Marcos Jr.See More.....

New Rural Bank of San Leonardo (N.E.), Inc., Celebrating 31 Years of Service with this year's theme "Celebrating Growth, Banking on a Sustainable Tomorrow"

June 27, 2025

This year marks a remarkable 31 years of commitment in helping build local economies and providing trusted banking services through lasting partnerships.See More.....

LOOK: New Rural Bank of San Leonardo (N.E.), Inc., Grace the street Dingalan Aurora during its 69th Founding Anniversary

June 16, 2025

The New Rural Bank of San Leonardo (N.E.), In., Dingalan Branch proudly participated in the vibrant Float Competition in celebration of the 69th Founding Anniversary of the Municipality of Dingalan, Aurora, under the theme “Dama ang Matatag na Dingalan sa Bagong Pilipinas.”See More.....

The New Rural Bank of San Leonardo (N.E.), Inc. Joins Brigada Eskwela 2025 Kick-Off Ceremony

June 9, 2025

The New Rural Bank of San Leonardo (N.E) Inc., joins the kick off ceremony of Brigada Eskwela 2025 with the theme “Brigada Eskwela: Sama-sama Para sa Bayang Bumabasa” at Mallorca National High School and Mallorca Elementary School last June 9, 2025. This program marked the start of a week-long preparation of classrooms and the school for the learners, as the Department of Education formally kicks off the School Year 2025–2026. It reflects a shared commitment to provide learners with clean, safe, and functional learning spaces.See More.....

New Rural Bank of San Leonardo (N.E.), Inc., Joins the CLSU Techno Village Development Program (TVDP) Stakeholders' Summit

June 2, 2025

The New Rural Bank of San Leonardo joins the Techno Village Development Program (TVDP) Stakeholders’ Summit, hosted by the Central Luzon State University (CLSU) University Extension Program Office last June 2, 2024. This summit aimed to strengthen partnerships and celebrate collective achievements in rural development and agricultural innovation. It brought together a wide range of participants, including farmer-partners from across Nueva Ecija, model farm owners, local government representatives, and key national agencies such as the Department of Agriculture–Agricultural Training Institute (DA-ATI) Central Luzon, Nueva Ecija Provincial Agriculture Office and Key institutional partners of CLSU.See More.....

New Rural Bank of San Leonardo (N.E.), Inc. Outstanding Rural Financial Institution (Bank) (National Finalist)

May 26, 2025

Para sa mga natatanging magsasaka at mangingisda. Bilang bahagi ng pagdiriwang ng National Farmers’ and Fisherfolks Month ngayong buwan ng Mayo, ang New Rural Bank of San Leonardo (N.E) Inc., ay binibigyang halaga ang walang sawang pagsusumikap at dedikasyon ng ating mga magsasaka at mangingisda upang matiyak ang ating seguridad sa pagkain at ang patuloy na pag-unlad ng lokal na ekonomiya. Ang New Rural Bank of San Leonardo (N.E) Inc., ay taos-pusong nagpapasalamat sa Kagawaran ng Agrikultura (DA) sa tiwala at pagkilala bilang Outstanding Rural Financial Institution sa Gitnang Luzon na iginawad nitong ika-26 ng Mayo.See More.....

New Rural Bank of San Leonardo (N.E), Inc. Strengthens Emergency Preparedness of Employees

May 24, 2025

The New Rural Bank of San Leonardo (N.E.), Inc. successfully conducted a series of safety preparedness seminars for its employees. The event aimed to enhance awareness and preparedness in emergency situations, reinforcing the bank’s commitment to employee safety and disaster readiness last May 24, 2025. The seminar includes Fire and Earthquake Preparedness and Basic First Aid, facilitated by the Bureau of Fire Protection (BFP) of San Leonardo and Bomb Threat and Explosion Preparedness.See More.....

NRBSL Recognized as Outstanding Financial Institution (Bank Category) at the 2025 Regional Gawad Saka Award

May 15, 2025

The New Rural Bank of San Leonardo, Inc. has been honored as the Outstanding Rural Financial Institution (Bank) during the Regional Gawad Saka 2025, held on May 15, 2025 at Subic Bay Travellers hotel, Subic, Zambales with the theme “Parangal sa Natatanging Magsasaka at Mangingisda ng Gitnang Luzon”. The Gawad Saka Awards, spearheaded by the Department of Agriculture, celebrate individuals and institutions that have made significant steps in improving agriculture and fisheries in the country. NRBSL stood out among its peers for its innovative financial services, community programs, and sustainable development initiatives designed to uplift rural areas.See More.....

TATLONG BANGKO AT ISANG MICROFINANCE NGO SA GITNANG LUZON, SUMALI SA BSP PISO CARAVAN

April 30, 2025

Kasali na sa Bangko Sentral ng PIlipinas (BSP) Piso Caravan ang tatlong bangko at isang microfinance non-government organization na may mga branches sa Gitnang Luzon. Pumirma ng pledge of commitment ang New Rural Bank of San Leonardo, Masagana Rural Bank, Inc., Gateway Rural Bank, Inc., at ang microfinance NGO na Alalay sa Kaunlaran, Inc. (ASKI) upang magsagawa ng currency exchange sa ilalim ng programa. Bukod sa Gitnang Luzon, may dalawang branches din ang New Rural Bank of San Leonardo sa Metro Manila at may 31 na branches ang ASKI sa Hilagang Luzon na kalahok sa caravan.See More.....

New Rural Bank of San Leonardo (N.E), Inc., Participates in 48th ADFIAP Annual Meetings

April 23 to 25, 2025

The New Rural Bank of San Leonardo (NRBSL) proudly took part in the 48th Annual Meetings of the Association of Development Financing Institutions in Asia and the Pacific (ADFIAP), held from April 23 to 25, 2025, in Muscat, Oman. This year’s 48th ADFIAP Annual Meetings hosted graciously by the Development Bank under the theme: “Economic Gardening and Development.” Bringing together member-institutions in forty-two (42) countries and territories in Asia Pacific and beyond, as well as representatives from ADFIAP’s global institutional partners and network. The event served as a vital platform for financial institutions and development organizations to share insights, experiences, and innovations aimed at fostering a sustainable finance ecosystem.See More.....

Partnership between NRBSL and Agrilever Philippines Breaks Ground in Climate-Smart Agriculture

January 8, 2025

Institutions engaged in agriculture lending had faced recurring challenges on information gaps. Personal and credit profile of farmer-borrowers; climate data and market/price indexes are not often available which affects overall risk assessment. With NRBSL-Agrilever partnership, farmers are given access to digital transformation tools that enhance both credit and farm management. The collaboration bundles NRBSL’s financing program with innovative digital solutions of Agrilever that revolutionize farming methodology.See More.....

NRBSL hosts International Study Visit on Integration of Innovative Technologies to Improve Agricultural Financing

February 20, 2025

The Asia-Pacific Rural and Agricultural Credit Association (APRACA) had chosen NRBSL anew for the Luzon leg of its study tour which include visitors from National Bank of India for Agriculture and Rural Development (NABARD), Bank of Ceylon and from other institutions Lecira Juarez, Secretary General of Asia-Pacific Rural and Agricultural Credit Association (APRACA). According to APRACA Secretary General Lecira “Bing” Juarez, the delegates wished to hear and learn both from the sides of government financial institutions and players on the ground and she could not think of a better choice than NRBSL. Senior executives of NRBSL took turns in presenting the unique perspective and practice of the Bank during the whole day activity.See More.....

Rural Bank Officials Visit CLSU to Discuss Farmer Support Partnership

February 13, 2025

Officials from New Rural Bank of San Leonardo N.E. Inc., led by its President & Chief Executive Officer, Mr. Abundio D. Quililan Jr., along with Mr. Marcelo Jampil, Senior Vice President & Chief of Staff, Ms. Francisca Lopez, Head of Inclusive Finance, and Mr. Yernon Angeles, Inclusive Finance Agricultural Value Chain Financing Program Officer, visited the University Extension Program Office on February 13, 2025, to explore potential collaboration opportunities to support local farmers through financing options.See More.....

The New Rural Bank of San Leonardo (NRBSL) provides information in this website solely as a resource for its users. While NRBSL tries to provide high quality content on its website, it does not guarantee the accuracy, reliability or timeliness of the information and, therefore, will not be liable for any damages or losses to the user that may result from the use of the website.

.jpg)