Reports & Publications

Financial Highlights

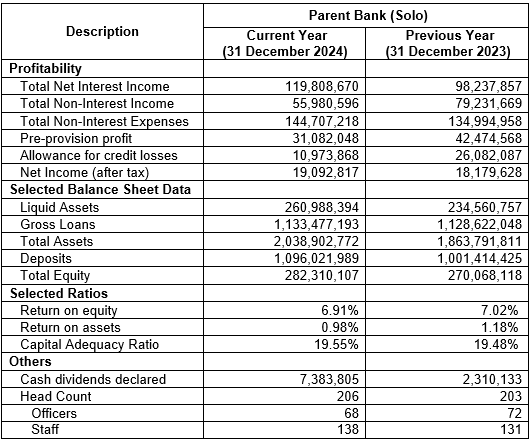

The New Rural Bank of San Leonardo (NRBSL) could not have reached its 30th year milestone in 2024 in a better note than its total resources crossing the P2.0 billion mark with a growth rate of 9.40%. This is the highest level of performance the Bank had posted in the last four (4) years which rendered it at par with that of the entire Philippine financial system with a record of 9.02% as of 31 December 2024.

Financial Summary / Financial Highlights

As of 31 December 2024 and 31 December 2023

|

NRBSL’s percentage-ratio-wise industry-at-par asset growth was also matched by a stronger profit generation. If NRBSL’s profitability rebounded from a slump in 2023, the Bank’s earning capacity stabilized in 2024 with P22 million increase in interest income revenues from core business of lending. It surpassed and sustained the P19 million net increase performance posted the previous year.

The Bank, however, experienced a drop in non-interest income earned in 2024 which is traced to its promotion of waiving penalties for late-payment on borrowers’ loan dues. Such a business decision is well-thought and purposeful both as a humanitarian act and a delinquency reduction and prevention strategy. As a result of these waived revenues, the pre-provision profits correspondingly went down from P42 million to P31 million. The increase in non-interest expense of P10 million which is P1 million less compared to the year prior helped to a certain extent. It only shows the Bank’s cost-consciousness in managing expense items, most of which are attributed to compensation and other personnel-related benefits. Again, for two consecutive years, the increase in profits helped the Bank absorbed operational costs past the break-even and with income from gain of asset sale excluded. The biggest contribution came from lesser provisioning expenses which posted a huge cut of P15 million on year-to-year comparison. This outcome meant that NRBSL delinquency control measures had paid-off with 2024 end-of-year, net-of-tax income of P19 million against P18 million in the previous period.

NRBSL’s practical and flexible approach to liquidity management that it started in the previous year continued and kept the level of the Bank’s borrowings with its major funding partners Land Bank of the Philippines (LBP) and Development Bank of the Philippines (DBP) low. This need-based and cost-conscious funding framework also eliminated idle funds and invested in low-risk deposit placements or no-risk instruments in the form of government securities. A significant contributing factor behind the reduction in Bills Payables is the substantial increase in the Bank’s deposit portfolio with additional P95M from year-ago level which stabilized the level after crossing the P1.0 billion milestone in the previous year.

Another stabilizer of NRBSL’s liquidity position are the Special Deposit Account (SDA) placements with NRBSL as alternative compliance with mandatory credit allocation on Agri-Agra by other banks which has remained intact. The reduction in a few placements were replenished by interest income and added to principal and rolled-over. It shows that despite the instant improvement of the compliance rate of banks as a result of relaxed implementation mandatory credit allocation under the new AFRD, there have been negligible withdrawals. The Treasury Department marketing efforts and some interest rate adjustments were behind the retention of most of these deposits. While expense on Agri-Agra deposits mildly increased, the cost is still cheaper compared to rates from borrowings. Again, NRBSL has proven the combination of right marketing and sound interest pricing was proven effective in funds management.

The re-launch of the Bank’s current account facility was intensified in 2024 and so did the promotion of small-size deposits among retailers and from targeted digital platform-users. Other deposit mobilization projects NRBSL started to campaign in previous year such as reciprocal deposits with loan clients; expansion of daily solicitation outside bank premises were sustained that helped drive deposit growth.

The performance of NRBSL in 2024 in the area of its credit portfolio is influenced by a number of factors. Some key borrowers during the course of the year prepaid the whole or part of their respective facilities either because of lump sum funds that came in or they became risk-averse after they encountered difficulties during the pandemic. Due to scale of these exposures, the ability of NRBSL’s sales force to replenish these departing borrowers was undermined. In the early 2024, the Bank started strong in loans generation as several major accounts came in. However, exposures to these key accounts were not enough to have a significant impact on loans outstanding as a greater number of borrowers terminated their loan accounts. Also, the revival of former borrowers which is part of the framework in credit origination contributed while loan products repackaged in 2024 added new borrowers. However, the pace of on-boarding has to step up much faster to accumulate volume relative to client fall-out rate in order to achieve expansion. Overall, the rate of replenishment in 2024 is just slightly higher than the rate of account closures thus leaving only P5 million as positive variance year-on-year.

Insights drawn from the experience in 2024 confirm the erstwhile strategy to get big-ticket accounts as an easier way to boost the Bank’s credit portfolio is not sustainable and it might have disturbing effects. Because of their size, these substantial exposures indeed bring instant impact on loans outstanding but they carry the same magnitude of an instant contraction once these loans are paid. Worse, they can cause a surge in delinquency in the event of past-due. In 2024 NRBSL’s portfolio expansion strategy involves on-boarding a multitude of new mid-to-small size accounts where loan settlements from time to time will not lead to any shake-up. Under this approach the credit risk is also dispersed across a number of borrowers. In spite of the outcome in loans outstanding 2024, a number of new credit programs have been added to NRBSL’s product lines, not to mention those revived and enhanced during the last 12 months. Creative approaches like offer of credit lines with a combination of regular and agricultural credit programs were also resorted to. These new packages are so designed to make the offerings of NRBSL competitive in the market and are expected to bear results in the succeeding years.

The sustained profitability of NRBSL, with income in 2024 even higher the level in the previous year, has helped duplicate the Bank’s ratio performance measured by Return-on-Equity and Return-on-Assets. The Bank managed to keep its ROE and ROA at 6.9% and 0.9% respectively which were statistically unchanged compared to previous year’s ratios. Likewise, NRBSL’s Capital Adequacy Ratio is stable at 19.55% which is a close approximation of 20% targeted level. With this profitability performance and stable liquidity condition, NRBSL made true its commitment by declaring a P7 million cash dividends for its stockholders which is P5 million higher than the amount disbursed the year thus ensuring return on their equity investments.

NRBSL introduced organizational development measures in 2024 by right-sizing and tailor-fitting personnel deployment instead of adding more employees in its roster. In 2024 the Bank’s official Plantilla of 206 officers and staff is higher by only 3 individuals from previous year. The growth is in the numbers of personnel in the organization who identifies with NRBSL and its purpose as their own. With product enhancements and calibration of processes, more Bank employees have gained mastery of mechanics that enable them to promote products and services while others have developed proficiency of policies that help them avoid errors. Many employees are now using Bank resources, name and goodwill in the appropriate manner to maximize efficiency and business opportunity.

In summary, the outcome of 2024 reflects the collective attitude of the members of its organization as it determines the altitude of the Bank’s financial performance. From the start of the year, all agreed to experience more, hence many gave more. More means more initiatives, more efficiency, more proficiency, more time, more focus, more collaboration, etc. Henceforth, the level of interventions reached a balance where every member of the organization, from the Board, senior officers, managers and staff contributed proportionately either in business generation or enhancements of processes. In 2024, NRBSL leadership realized anew that the best way to teach is by example and through actual performance. The sheer size of NRBSL’s organization and network of its branches including pool of clientele; its accreditations and collaborations and; its brand name and goodwill all worked in favor of the Bank and with these attributes it managed to cross P2 billion asset milestone and earned P19 million profits for year 2024.